Blog

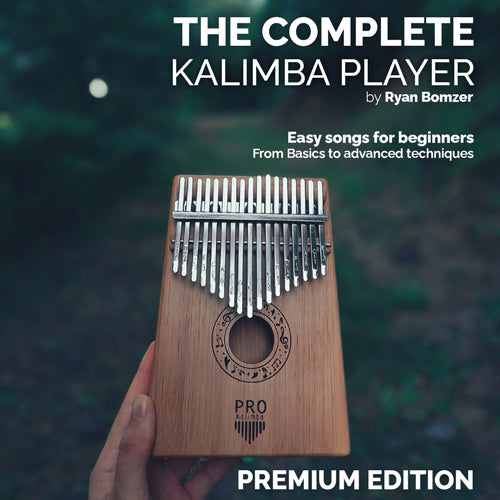

Who founded Carved Culture?

Musician Ryan Bomzer founded Carved Culture in Brighton, East Sussex. From a young age, Ryan was fascinated by music, spending hours watching music...

Traditional Italian Sùgoli Recipe

Sùgoli is a sweet pudding that brings the flavors of the Italian countryside to life. Originating in Northern Italy, particularly in Emilia-Romagna...

How To Play The Washboard

A washboard is traditionally made of metal, with ridged, ribbed surfaces that create a unique scraping sound when rubbed. It was initially used as ...

Top 10 Most Popular Guiros

With so many different types of güiros available, choosing the right one can be overwhelming. To help you find the perfect fit, we've curated a lis...

How to Play the Bamboo Buzzer (Tutorial)

The bamboo buzzer is a traditional instrument known for its unique sound, particularly in Southeast Asia. It is a sound effect instrument ...

Kashaka Shaker - Complete Guide

In this complete guide, we will the kashaka shaker, its origin,different types, where to buy, how to play and much more. The Kashaka, sometimes kno...

Everything You Need to Know About Rainsticks

In this guide, we will be showing you everything you need to know about rainsticks. These instruments are typically crafted by indigenous communiti...

How To Use A Gong (Tutorial)

Gongs are more than metal discs—they're used in music, meditation, and ceremony. This guide covers their purpose and how to play them for the best ...

How To Play The Bird Caller

Bird callers are cool woodwind instruments that mimic the vocal patterns of real birds. They are great for musicians, people who love nature, sound...

How to Play the Musical Saw for Beginners

This quick guide will show you how to play the musical saw. Before you start, make sure the saw you choose is blunt, not sharp. Musical saws are me...